🔐 Quarter century of Trademark Trends:

What the Data Reveals About Brand Expansion in the Eurasian Regions

Over the past 25 years, the landscape of international trademark registrations has come over various trends — driven by crisis, reveal periods, regulatory changes, and evolving business strategies. By analyzing the total number of registered trademarks across countries from 2000 to 2024, several key insights emerge.

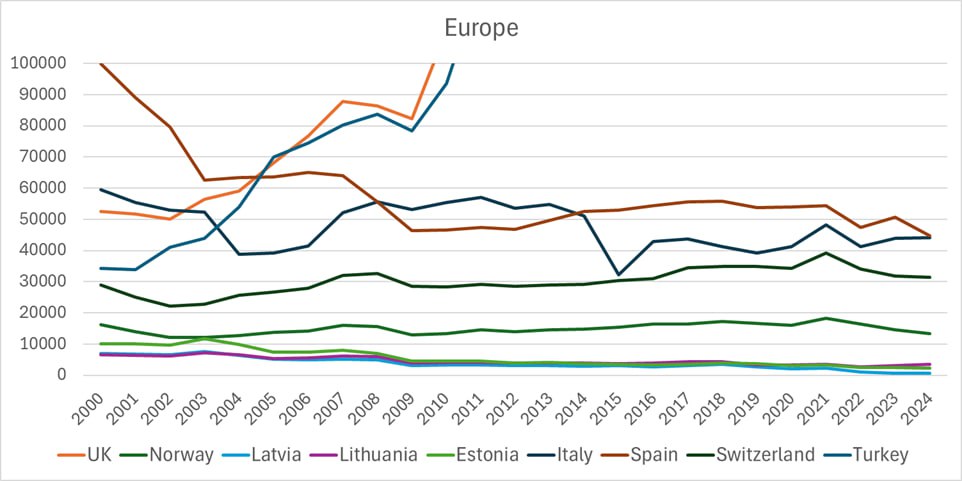

📈 Europe: A Stable and Open Environment for Global Brands

European countries have consistently maintained strong engagement with international trademarks. Most countries have a long story of intellectual property business. This results in quite stable numbers of the registered trademarks with few exceptions.

The data on the graph reflects Europe's openness to global markets and its mature approach to IP protection. The EU common market plays a key role in this trend, offering streamlined trademark registration across multiple countries.

Another common European trend is the peak of registrations in 2021 after a pandemic year with a slight decline in the next years.

The bright exceptions are UK and Turkey. Though they are located outside continental Europe, still they have tight business connections with it.

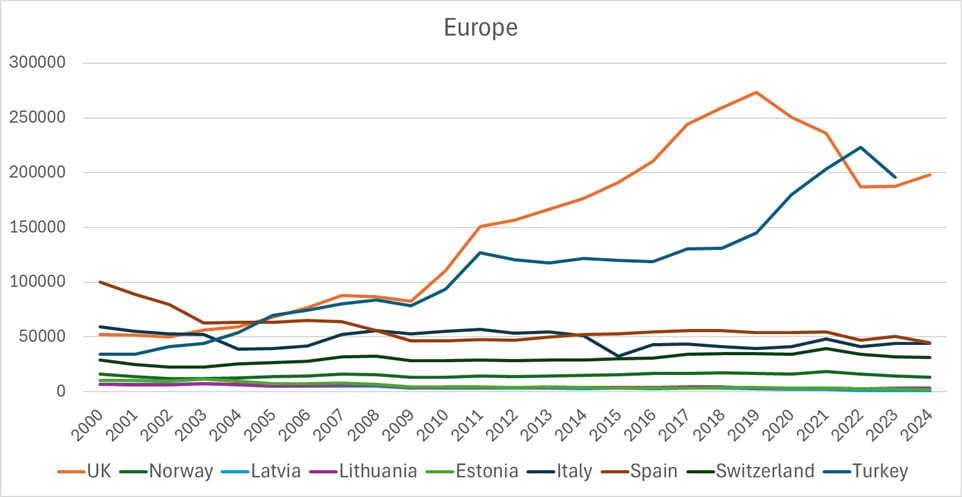

Turkey: A Country on the Move

Turkey presents one of the most dynamic stories in this dataset. From 34,307 in 2000 to a peak of 223,221 in 2022, Turkey rapidly increased its trademark activity, signaling both domestic brand development and increasing foreign interest. However, by 2023, the number fell to 195,901, which is likely to be caused by the national economic crisis rather than by the external factors.

UK: The most dynamic market.

Great Britain has shown the highest growth rate in the first decades after Millenium. However, it hardly started to reveal after the pandemic crisis of 2020 in the last year.

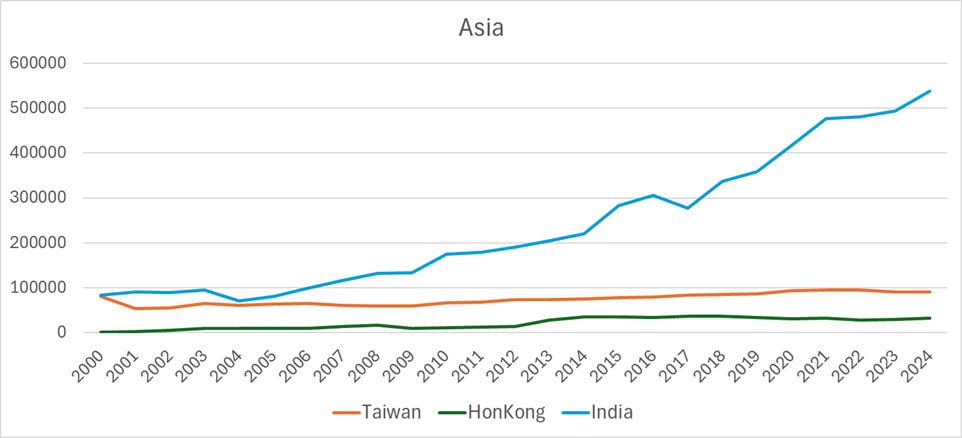

🚀 Asia: Growth, Plateau, and Divergence

India has shown explosive growth, especially from 2010 to 2022, going from 174K to 494K trademarks, and hitting a record 538K in 2024 — positioning it as a global IP powerhouse.

Taiwan and Hong Kong maintained steady growth, though at lower volumes, reflecting their smaller markets but strong IP infrastructure.

China (not shown here but known from broader trends) dominates in raw volume, but India’s rise is particularly noteworthy.

The Asian countries show a good resistance to global crisis. There were no significant declines neither in 2008-2009 nor after Pandemic 2020.

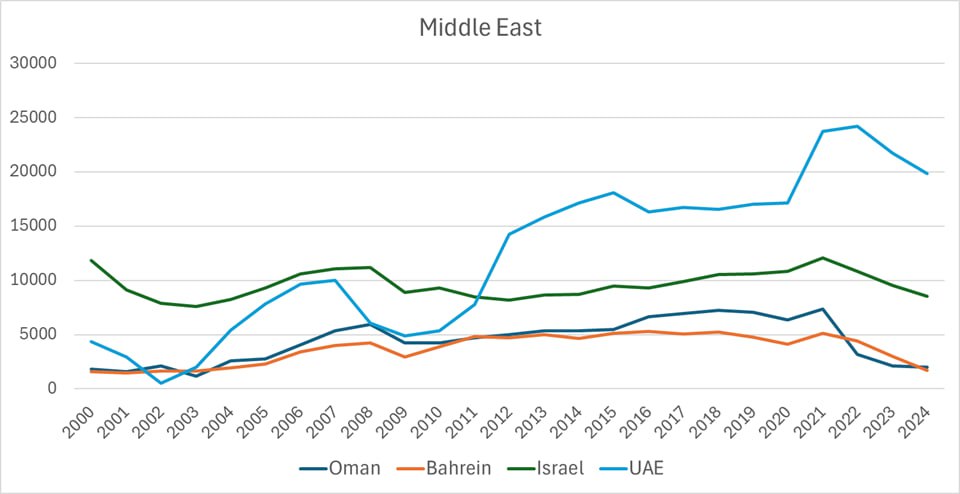

🏜️ Gulf Countries: Modest but Growing Presence

Trademark numbers in UAE, Israel, Oman, and Bahrain are significantly lower in comparison but have shown consistent growth up to 2021. For instance:

UAE: From just 4,338 in 2000 to 23,712

Israel: From 11,857 to 12,050 etc.

These figures have reflected expanding regional economies and increasing foreign investment in the Middle East.

The common trends for these countries are the sensitivity to the Global crisis situations:

1. In all countries the number of the registered TMs declined in 2008-2009.

2. Also it goes down after the growth in 2021.

🔍 What This Means for Global Businesses

Europe remains a reliable, high-value IP hub — crucial for companies aiming at a sustainable, long-term global presence.

India has emerged as a major market, with a soaring number of trademark filings that indicate both growing innovation and demand for brand protection.

Turkey, the Gulf states, and Southeast Asia are dynamic regions that demand attention, though with different levels of stability and opportunity.

💼 Your Trademark Strategy Matters

In a globalized economy, choosing the right jurisdiction for IP protection can make a difference between scalable growth and unnecessary friction. Whether you're launching in Europe, Asia, or the Middle East — aligning with local trends and policies is key.