IP Attorney Market Concentration

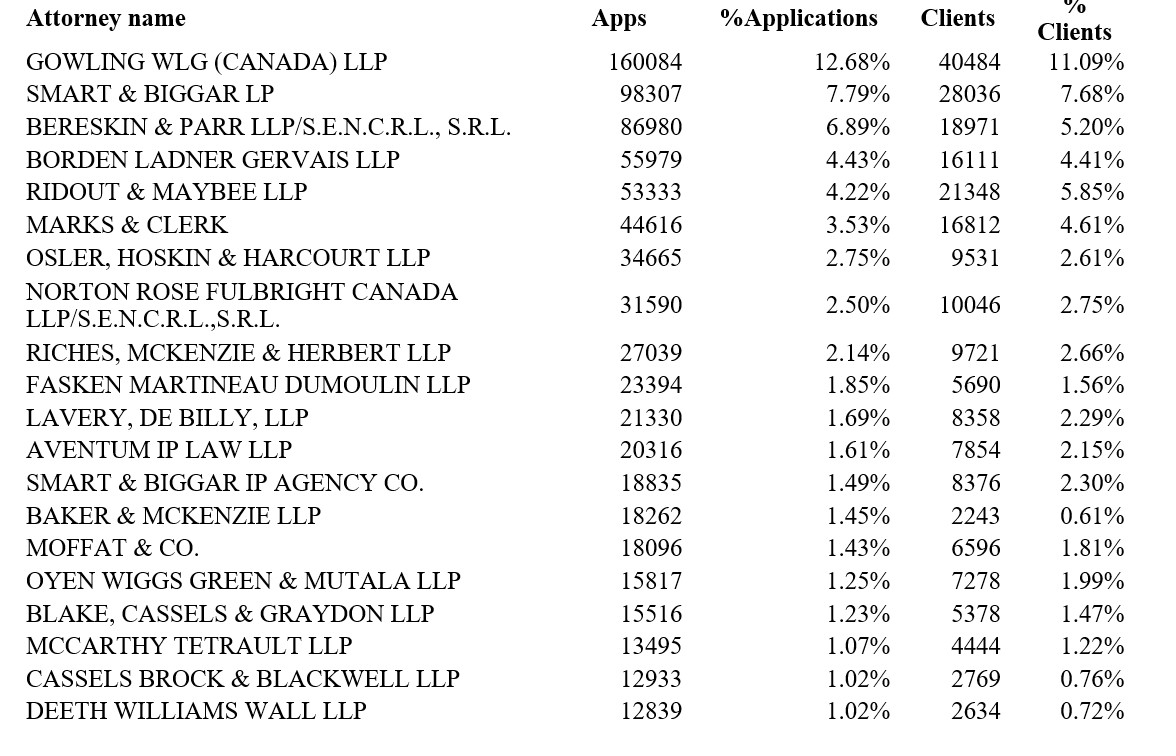

The market for intellectual property (IP) attorneys varies widely from country to country. While in some jurisdictions the industry is fragmented across many firms, others are highly concentrated, with just a handful of players dominating trademark filings. We have chosen some random countries from various regions - UK, Israel, Turkey, India, and Canada. Let’s explore this recent data.

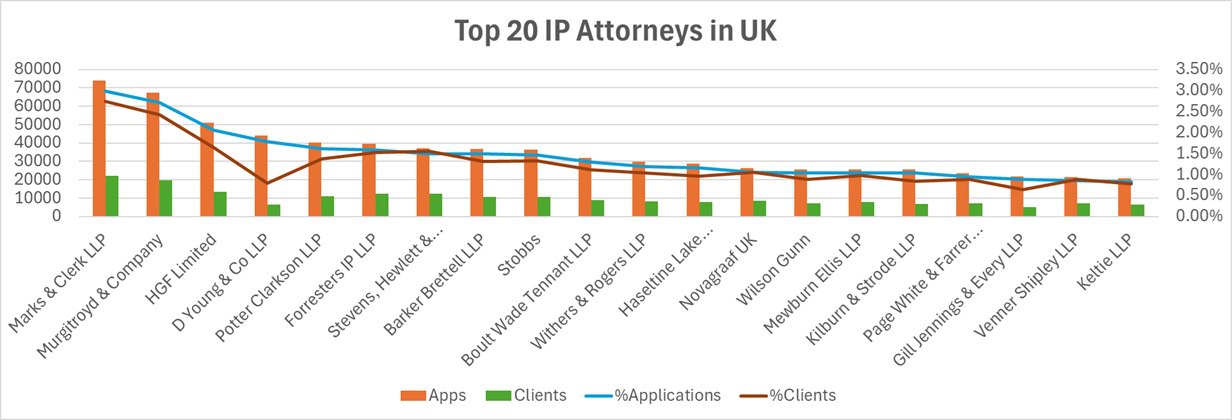

United Kingdom: A Balanced but Fragmented Market

In the UK, no single firm dominates the landscape. The leader, Marks & Clerk LLP, handles just under 3% of national trademark applications and 2.75% of clients. Even the combined top 20 firms account for only 28.5% of filings and 24.7% of clients.

This fragmentation suggests a competitive market where smaller and mid-sized firms retain significant influence, and clients have a wide range of choices.

Top 20 IP Attorneys in UK

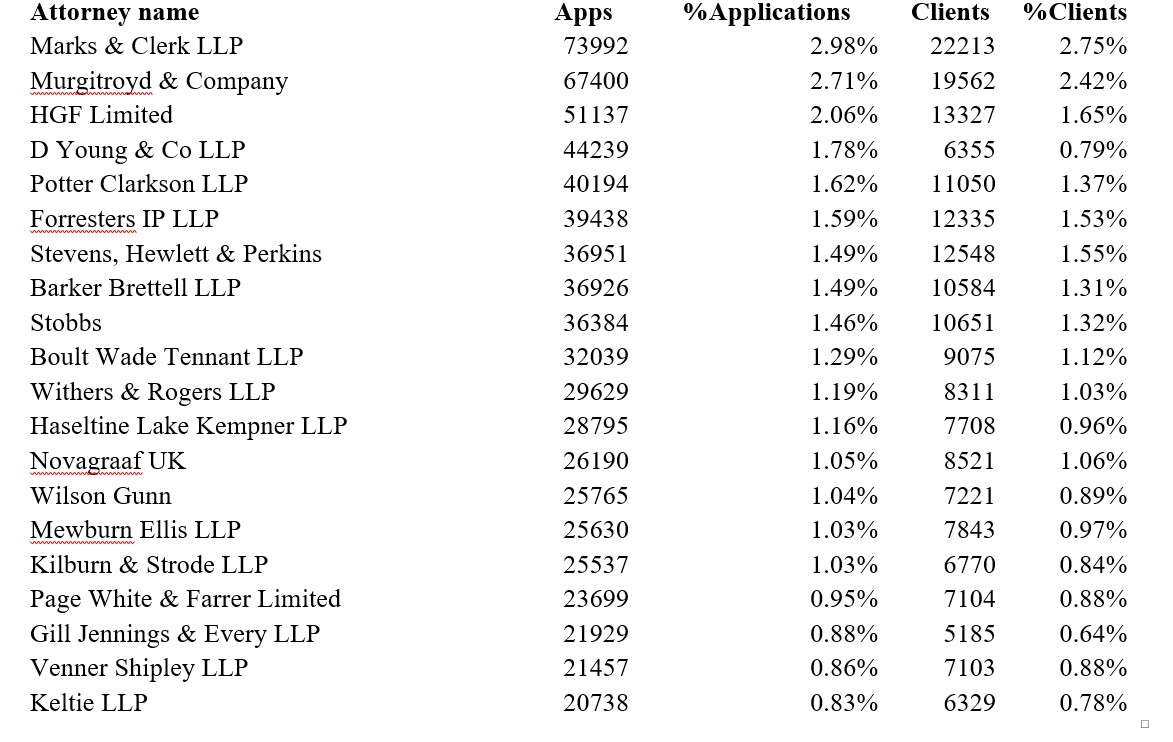

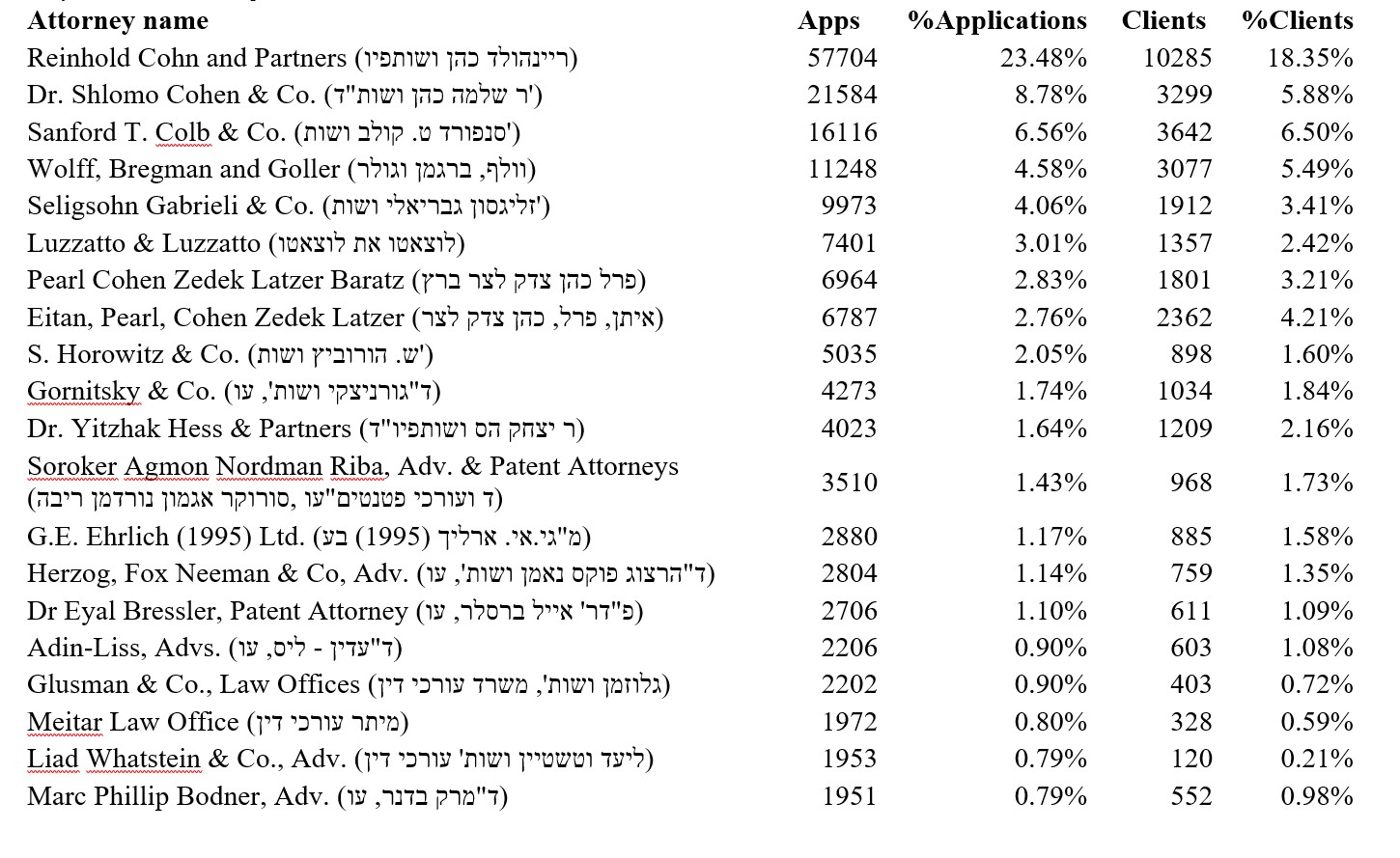

Israel: A Market Ruled by Giants

By contrast, Israel is strikingly concentrated. The leading firm, Reinhold Cohn and Partners, controls 23.5% of applications and nearly one in five clients. The second and third firms, Dr. Shlomo Cohen & Co. and Sanford T. Colb & Co., also hold substantial shares. Altogether, the top 20 firms represent more than 70% of all filings and 64% of clients. Here, the market structure favors entrenched incumbents, creating high barriers for smaller firms to challenge the leaders.

Top 20 IP Attorneys in Israel

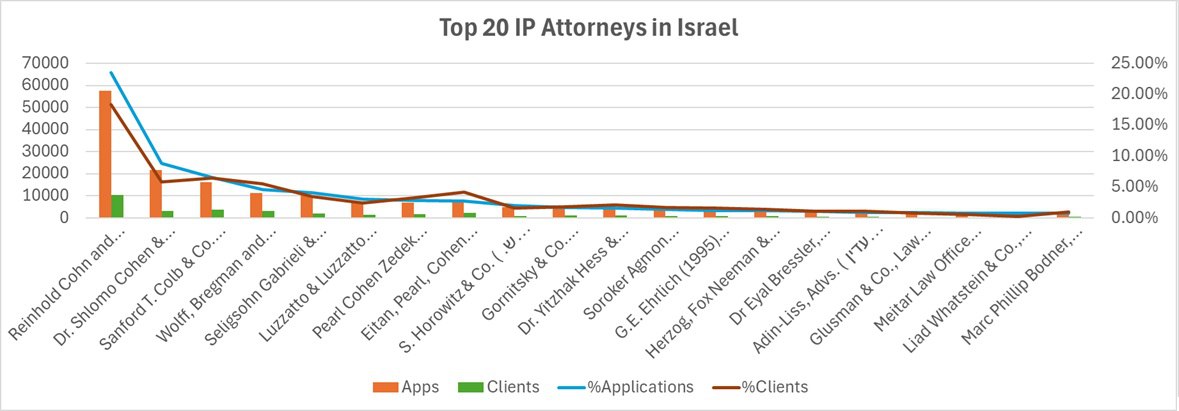

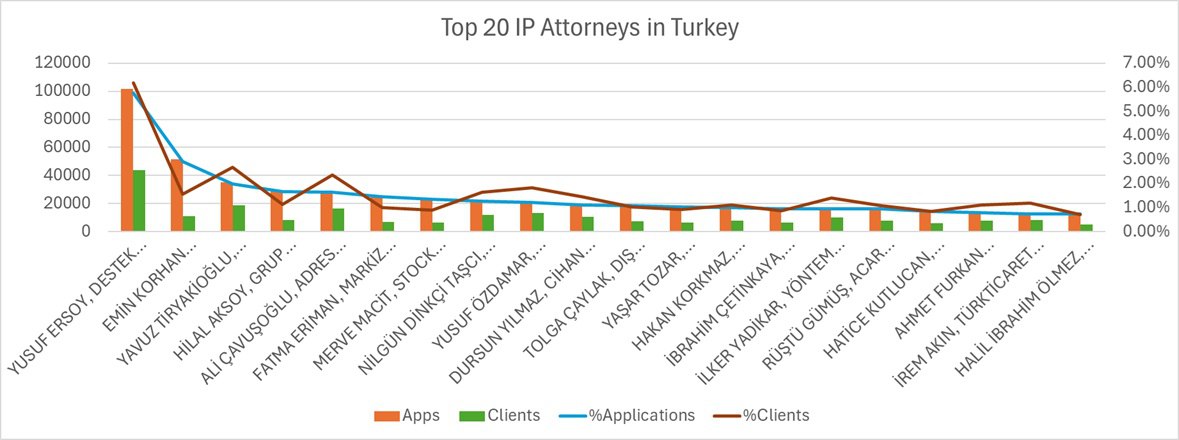

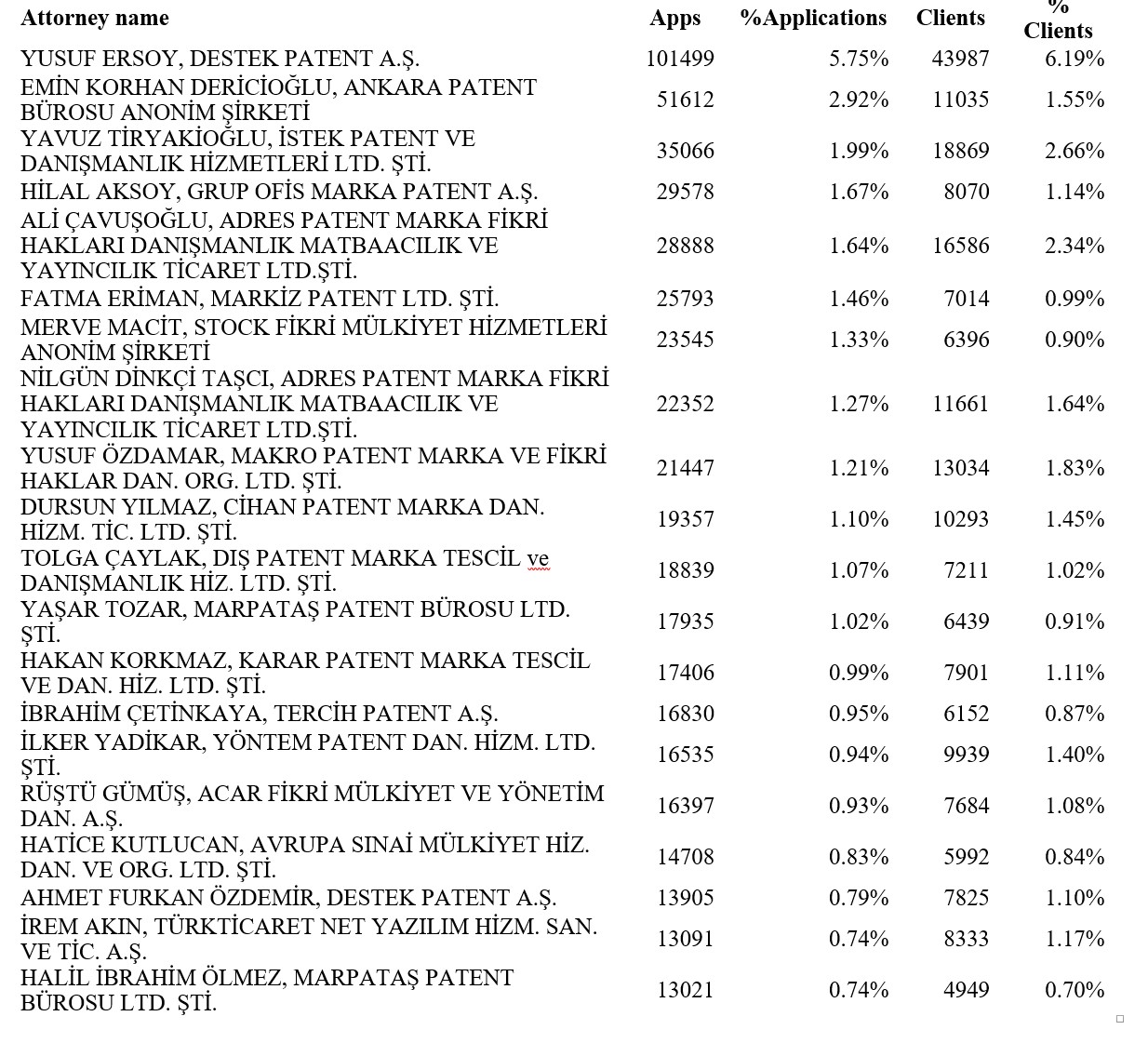

Turkey: Mid-Level Concentration with a Competitive Edge

Turkey shows an intermediate pattern. The largest firm, Destek Patent A.Ş., holds a 5.8% share, while the top 20 collectively cover 29.3% of filings and 30.9% of clients. This suggests moderate concentration, but still a vibrant level of competition. Several firms, such as Ankara Patent Bürosu and Istek Patent, command between 2–3% of the market, leaving space for new entrants.

Top 20 IP Attorneys in Turkey

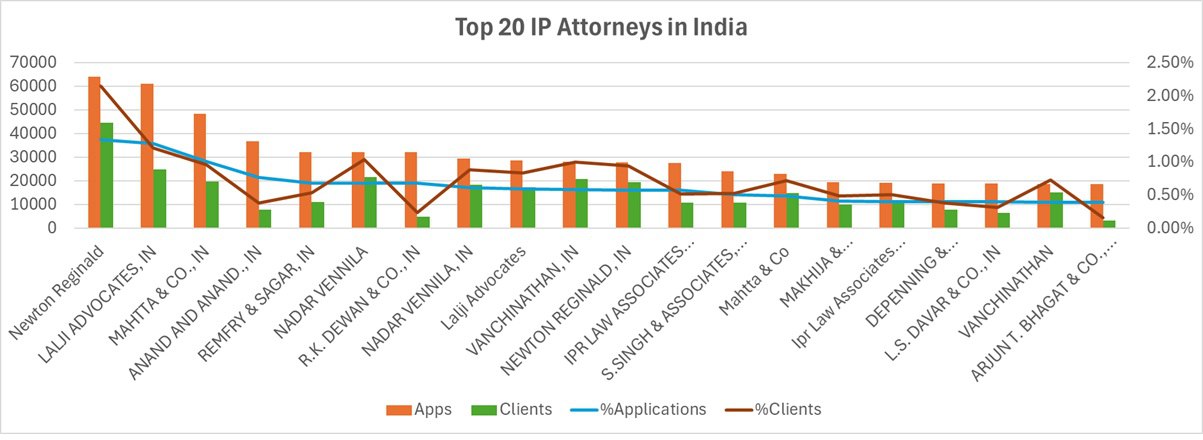

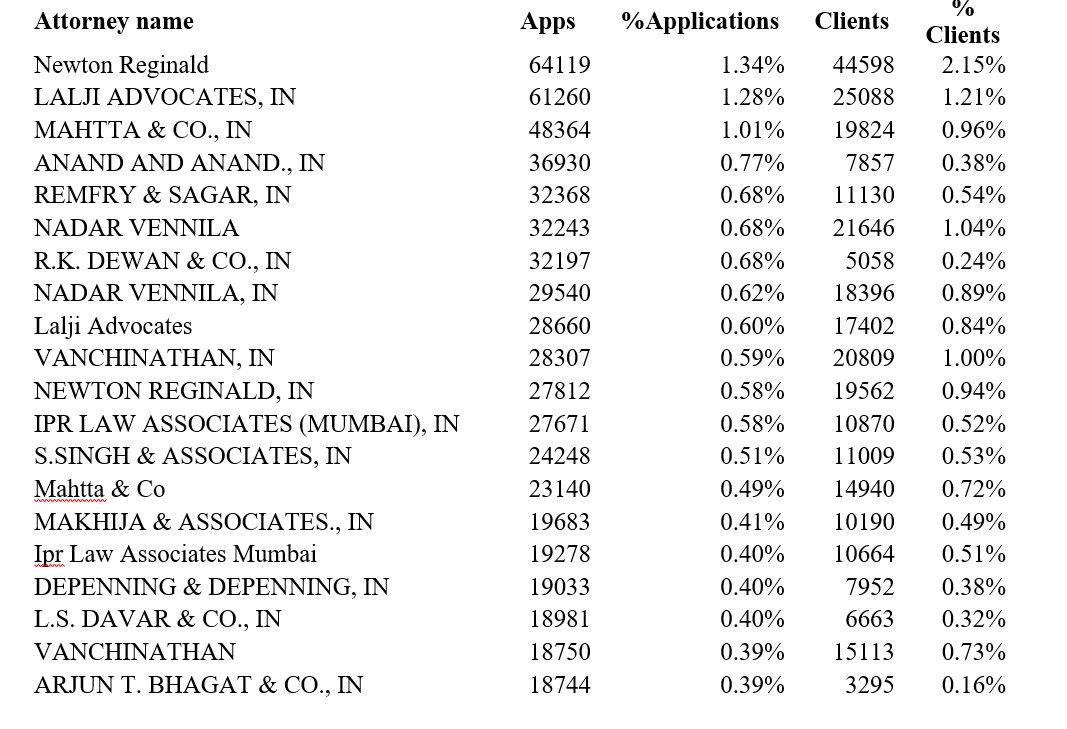

India: A Fragmented Powerhouse

India’s attorney market is extremely fragmented. The leading firm, Newton Reginald, represents just 1.3% of filings and 2.1% of clients. Even the combined share of the top 20 firms is only 12.8% of filings and 14.6% of clients—the lowest concentration among the countries analyzed. With such dispersion, the Indian IP market is arguably the most competitive, with thousands of smaller practitioners sharing the bulk of trademark work.

Top 20 IP Attorneys in India

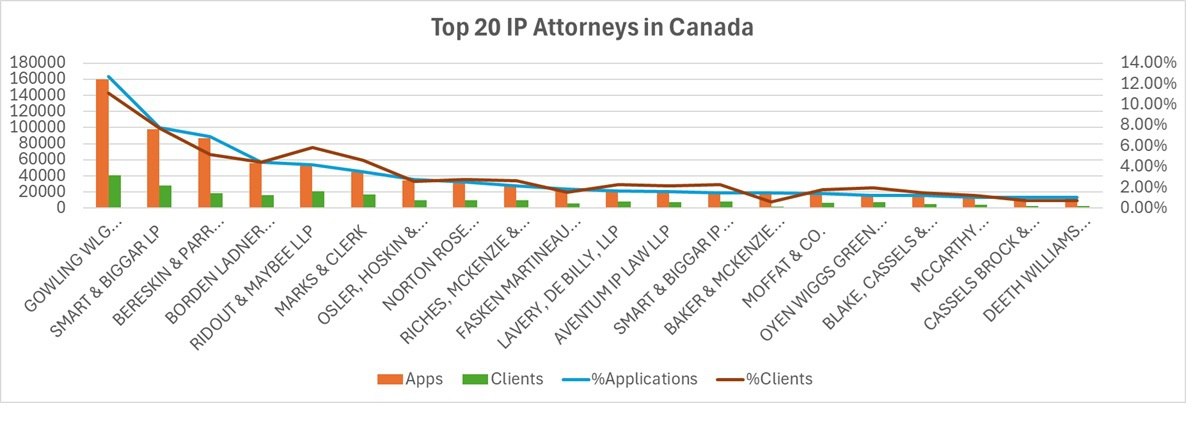

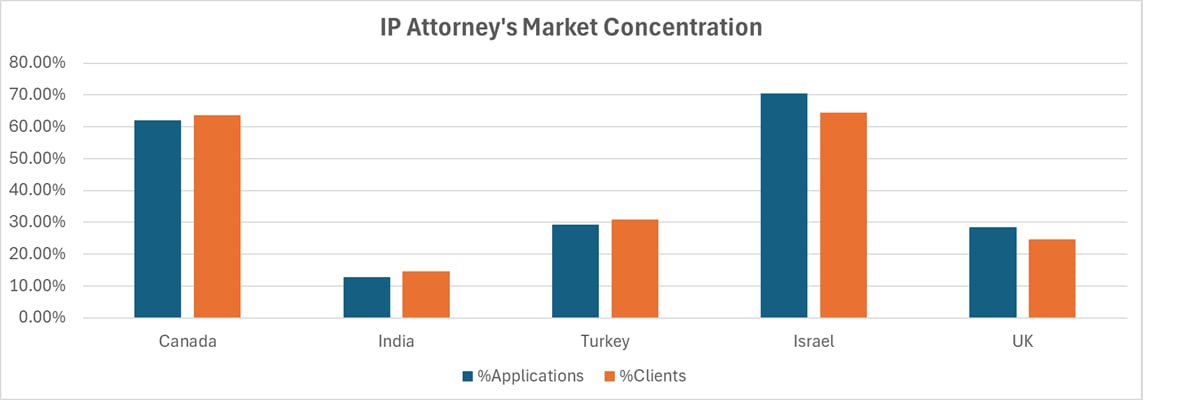

Canada: A Concentrated, Established Market

Canada lies at the opposite end of the spectrum from India. Here, Gowling WLG dominates with 12.7% of filings and 11.1% of clients, followed by Smart & Biggar (7.8%) and Bereskin & Parr (6.9%). The top 20 firms account for 62% of filings and 64% of clients, pointing to a mature market where established players have cemented their influence.

Top 20 IP Attorneys in Canada

Key Takeaways

- Highly concentrated markets (Israel, Canada) provide stability and established expertise but may reduce competitive pricing.

- Fragmented markets (India, UK) offer clients wider choice, though consistency and quality may vary.

- Moderate markets (Turkey) balance competition with identifiable leaders.

For businesses seeking IP protection abroad, these dynamics matter. In concentrated markets, clients may find fewer firms with extensive reach but stronger reputations. In fragmented ones, choosing the right partner requires more due diligence but could yield cost advantages.

In general, we can conclude that the more developed the market, the less concentrated it is. So, the principle holds often: as markets mature and internationalize, client demand spreads across more firms, lowering concentration. But local structure matters: Canada shows that even in developed economies, historical giants can preserve dominance.